Red Sea Conflicts Now Affecting Trade

As beginner investors, read the news daily to keep up to date on what is happening to the companies where your money is invested.

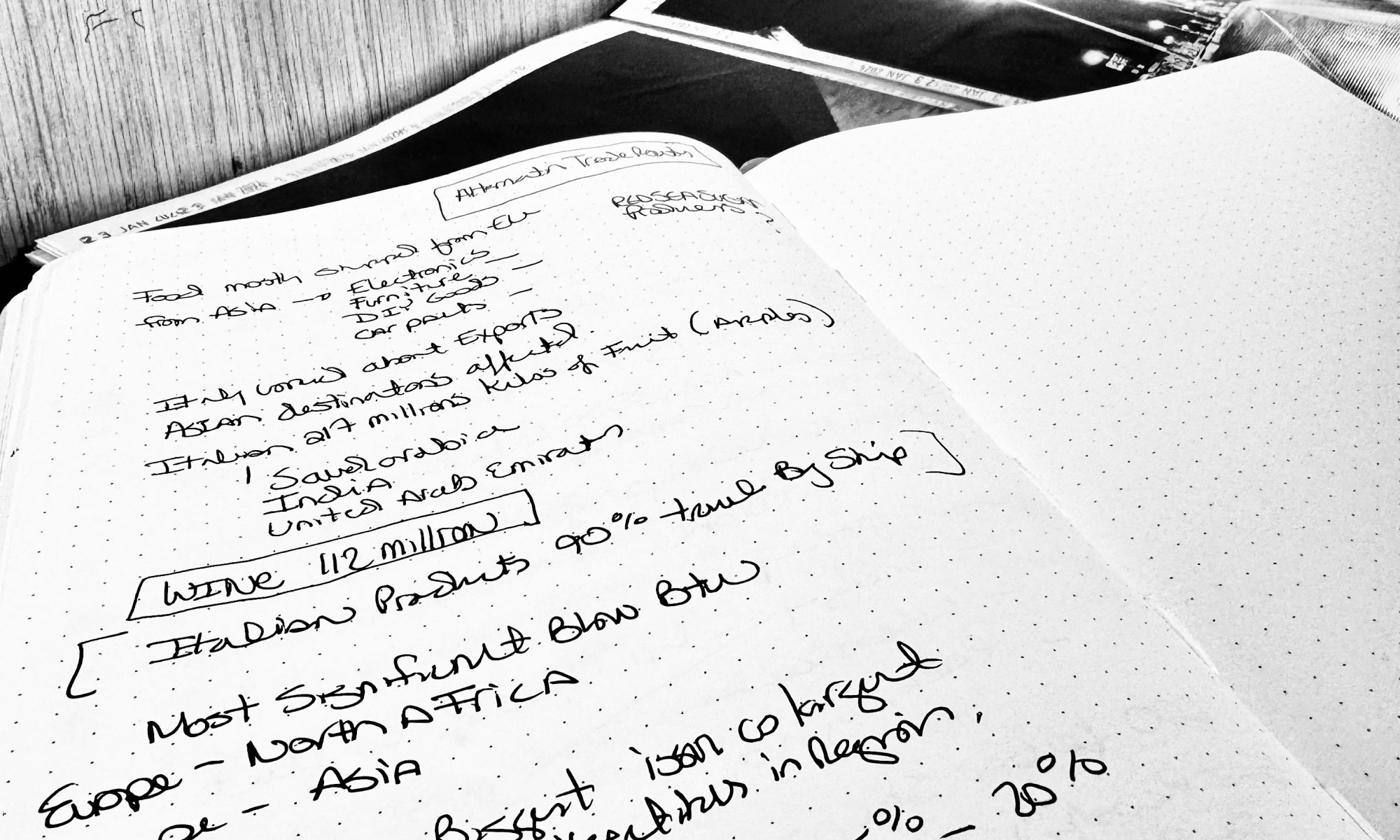

In today’s news, there are several articles talking about the Red Sea conflict and how this is affecting business.

The business affected by the UK/US supported conflict are European, North African, Middle Eastern and Asian.

12 percent of the world’s trade is going through this Red Sea Area and it is estimated that imported products such as electronics, Furniture, DIY Goods may see an increase in price and a delay in delivery of up to two weeks.

The exportation of food products such as rice, coffee, and wine are estimated to increase in price over the next few months because of this regional conflict affecting global business.

Investing in food such as rice or coffee beans is called investing in commodities. Commodities are raw materials such as food but also include gold, aluminum, and oil.

The price of Commodities futures is something interesting to watch right now as the conflict was not expected but is a conflict in a region of conflicts.

As investors, look to see how past conflicts affected the commodities market and watch how the market is affected by the current red sea conflict. Investing in commodities future is not for the beginner investor but is helpful in finding companies to invest long term.

If you want to watch along with the stockbrokers, look at future contracts, options and exchange funds to see how the red sea conflict is affecting futures of Italian apples, Coffee beans & aluminum.

Remember as a beginner investor, your investments are being made for long-term. Do not feel pressured to invest in commodities. Watch the markets and make investments in peripheral businesses that help resolved issues caused by the conflict.

If you are living in the UK or Australia, everything that is not produced on the island must be imported into the country.

It has been reported that prices for shipping have increased 15%. In the UK, see if this increase in shipping is affecting the price of products available to consumers.

Keep track of the Red Sea conflict and how it affects the commodities market in 2024. Pick a few logistic stocks and keep track of the businesses used to deal with the conflict and how the conflict affects the distribution chain of businesses in Europe, Africa, Middle-East and Asia.

Your investments are long-term. The best deals at the moment would have been last year. Now is the time to watch, learn, and prepare to invest.

23/1/24 E. Horstkamp